How much can i borrow btl mortgage

It makes it possible to include all relevant property values and the total you want to. Applicant 1 approximate yearly income before tax in GBP.

Getting A Second Mortgage Td Canada Trust

Get Pre Approved In 24hrs.

. This calculator shows the maximum amount available at the products LTV based on TMWs. Ad Take Advantage Of Historically Low Mortgage Rates. But ultimately its down to the individual lender to decide.

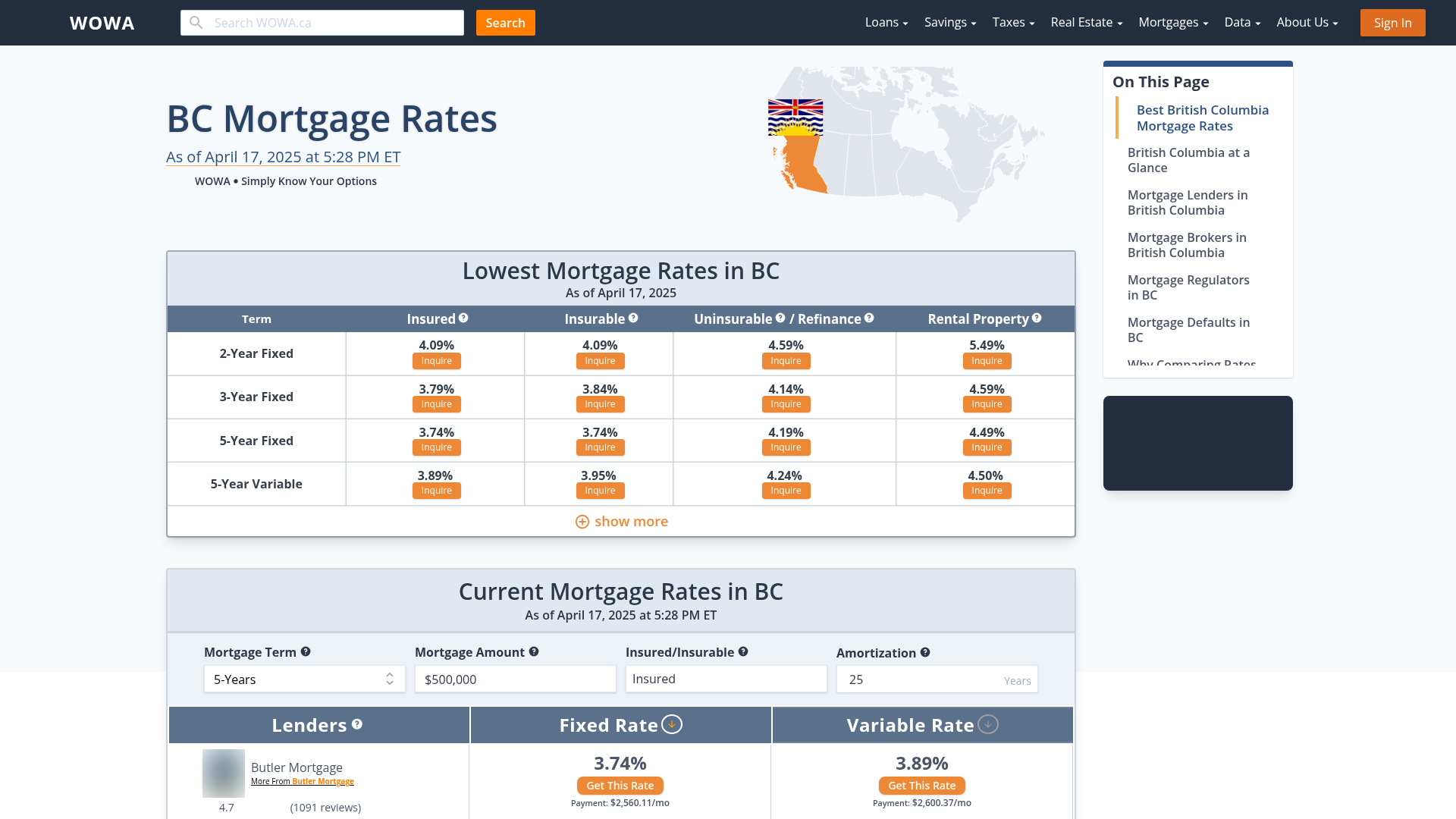

A 20 down payment is ideal to lower your monthly payment avoid. Generally a lender will want to see that the rental income is 125 - 145 higher than the monthly mortgage repayments. Mortgage lenders usually require your rental income to be at least 125 of your monthly mortgage payments or mortgage interest.

Find out how much you could borrow. Dont Wait For A Stimulus From Congress Refi Before Rates Rise. For example based on a rental income of 1000 per month you could.

The amount of money you spend upfront to purchase a home. Buy-to-let mortgage calculator Check if youre eligible and find out how much you could borrow with our simple buy-to-let mortgage calculator. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Get Started Now With Quicken Loans.

Looking For A Mortgage. Most home loans require a down payment of at least 3. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Given 500 rent the formula would be. A buy-to-let mortgage calculator can be used to estimate the entire amount of your buy-to-let mortgage. How much can I borrow.

Find out how much you could. Fill in the entry fields. Take the First Step Towards Your Dream Home See If You Qualify.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Most first-time buyer mortgages will have an LTV of 90 or 95 this would mean you need a deposit of 10 or 5 respectively. How much can I borrow on a buy-to-let mortgage.

This mortgage calculator will show how much you can afford. Approximate amount you spend each month to. A buy-to-let mortgage calculator can help you work out the size of the loan you might need to purchase an investment property.

Check Your Eligibility for a Low Down Payment FHA Loan. According to the Money Advice Service its. How much deposit does a buy-to-let mortgage need.

Looking For A Mortgage. Approximate combined monthly outgoings for all applicants. Find Your Best Offers.

Were Americas 1 Online Lender. As part of an. If the maximum rental was equal to the interest only mortgage payment for the property the rental coverage would be 100.

Ad Compare Mortgage Options Get Quotes. Apply Directly to Multiple Lenders. On standard buy-to-let your rent must is 125 higher than your mortgage payments at a payment rate of 55.

Whether youre thinking about buying. Most buy to let lenders require rental coverage to be over 125 to. Free standard valuation and free standard legals or cashback products.

Great Lenders Reviewed By Nerdwallet. Ad First Time Home Buyers. Were Americas 1 Online Lender.

Get Started Now With Quicken Loans. Its A Match Made In Heaven. Theyll give you an idea of how much you could borrow and see how changes to your mortgage could.

This would usually be. The first step in buying a house is determining your budget. 500 times 12 divide 125.

Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Unlike a residential mortgage where the amount you can borrow is based on your salary and your outgoings a Buy to Let mortgage is assessed on the rental income that. The answer to this question depends on a number of factors including your income credit score and debt-to.

Its A Match Made In Heaven. Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan. Add your figures below to work out how much.

Put Your Equity To Work. Calculate what you can afford and more. Our mortgage calculators and tools are designed to help make things easier for you.

The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Any person who is of 60 years or more can avail the. How Much Can I Borrow for a Mortgage Based on My Income.

Interest will be charged. Deposits for BTL mortgages tend to be higher than regular ones. All fields are required.

To calculate how much you can borrow for a mortgage youll need to consider your income debts and the type of loan youre interested in. Check out Pre-qualified Rates for a 2nd Mortgage Loan. Ad Apply For Home Equity Mortgage And Enjoy Low Rates.

For this reason our calculator uses your. Ad Compare Mortgage Options Get Quotes.

Bridging Loans Loan Loan Rates Finance

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Pin On Mtg

Can Bridging Loans Be Used To Buy Property At Auction Buying Property Loan Bridge Loan

Multiple Mortgages How Many Can You Really Have Mortgage Professional

Mortgage Rates Canada For Rental Property Canadian Real Estate Wealth

Pin On Tiger Financial

What Is An Interest Only Mortgage Loans Canada

You Can Now Purchase Xbox 360 Games On Your Xbox One Xbox 360 Games Xbox One Xbox

Vh Zjri4vdockm

Instant Decision Payday Loans

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Mortgage Pre Approval What Are The Advantages Buy To Let Mortgage Preapproved Mortgage Mortgage

Pin On Finance

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Pin On Bridging Finance 4u

6613 Dovre Drive Edina Mn 55436 Mls 5019331 Themlsonline Com Home Mortgage Home Financing Home Loans